Inheritance By Representation In Korea

My grandparent in Korea passed away recently, but my parents had already passed away. Do I have the right to the inheritance?

Simply saying, yes, you have the right to inheritance by representation. This article is an advanced explanation for the previous inheritance article about Korean inheritance law.

Table of Contents

Inheritance By Representation In Korea

1. Basic principle – The Right Holders of the Inheritance

First things first. Who has the right of inheritance in Korea? As we already have discussed in the former article, your family members have the right. Specifically, the right holders are decided by the Civil Act Article 1000.

According to the Civil Act Article 1000, persons become inheritors in the following order:

-

-

- Lineal descendants of the inheritee;

- Lineal ascendants of the inheritee;

- Brothers and sisters of the inheritee;

- Collateral blood relatives within the fourth degree of the inheritee.

-

“Lineal descendants of the inheritee” mean children and grandchildren, etc. of the one who has passed away. “Lineal ascendants of the inheritee” mean parents and grandparents of the one who has passed away.

The order and share of inheritance of a spouse are stipulated in Articles 1003 and 1009.

Article 1003 (Order of Inheritance of Spouse)

(1) If there exist such inheritors as provided in Article 1000 (1) 1 and 2, the spouse of the inheritee becomes a co-inheritor, in the same order as the said inheritor. If there exists no inheritor, the spouse becomes the sole inheritor.

Article 1009 (Statutory Share in Inheritance)

(2) The share inherited by an inheritee’s surviving spouse shall be increased by 50 percent over the inherited share of the inheritee’s lineal descendant where the spouse inherits jointly with such descendants, or 50 percent over the inherited share of the inheritee’s lineal ascendant where the spouse inherits jointly with such ascendants.

We will explain further how these rules are applied in specific cases.

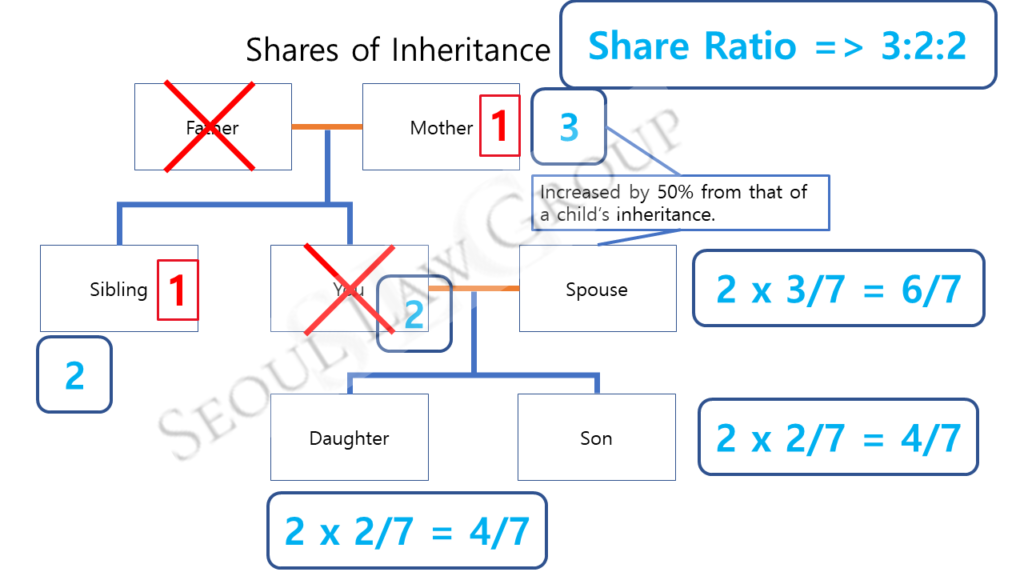

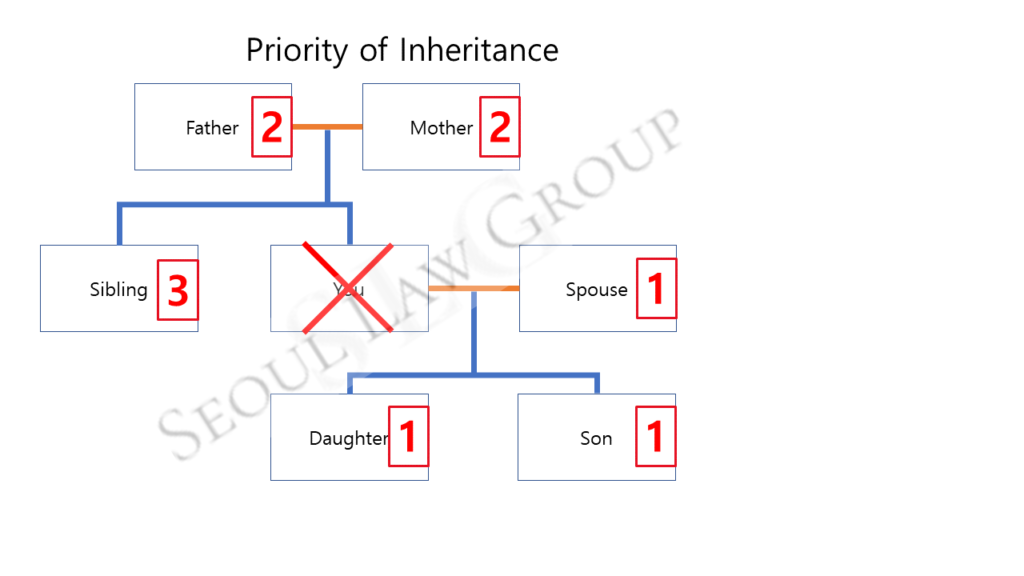

2. Specific Cases of inheritance

Suppose you have a father, a mother (only heterosexual marriage is allowed in Korea so far), and a sibling. Plus, you got married, so you have a spouse, your daughter, and your son.

Your family tree will be like this image.

3. Case No.1

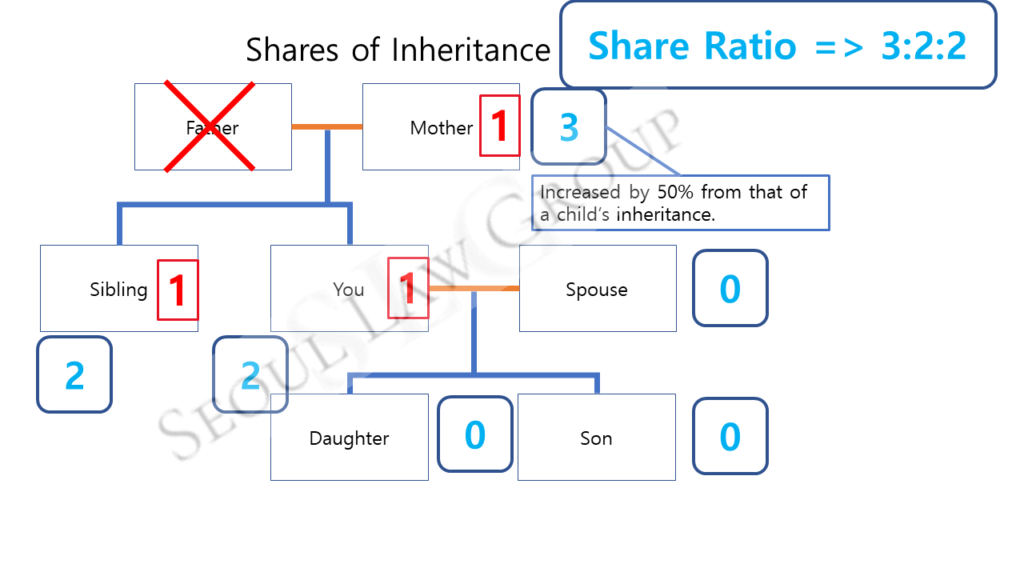

Suppose ‘You’ have passed away. Your daughter and son, as your lineal descendants, will be at the 1st rank of priority. Your father and mother, as your lineal ascendants, will be at the 2nd rank. Your sibling is at the 3rd rank. (We will not discuss the 4th rank for a simplified explanation) Plus, according to Article 1003, your spouse will become a co-inheritor of the 1st rank inheritors (in this case, will be your children). As a result, your children and your spouse will inherit your properties, while your parents and a sibling will get nothing (because your children and your spouse outrank the others).

The portion of inheritance for your spouse will be increased by 50% of your children. Therefore, your daughter, your son, your spouse will inherit by a ratio of 2:2:3. (1:1:1.5)

A visual explanation version would be like this.

This is the basics of inheritance in Korean Law.

4. Case No.2

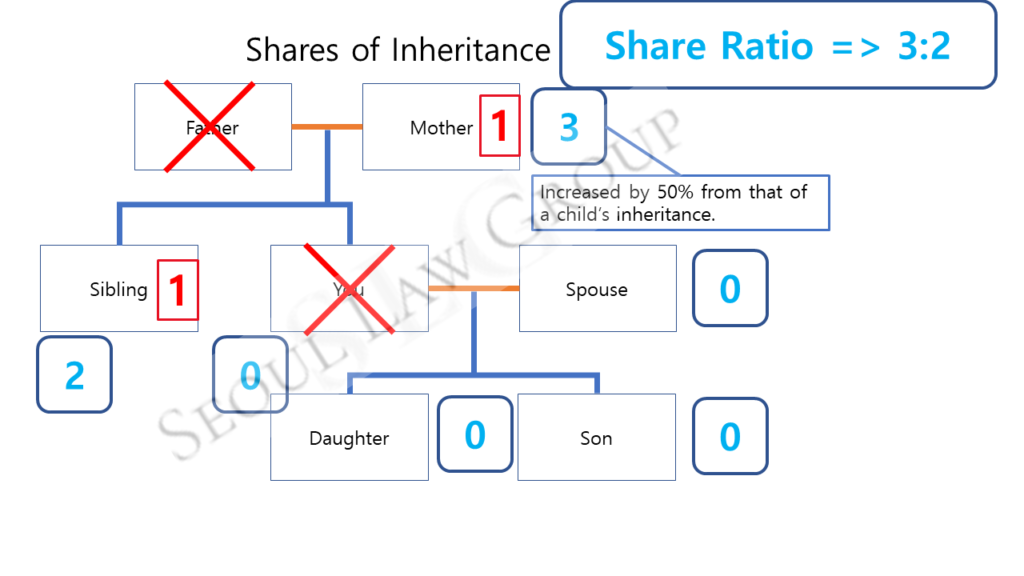

Let’s suppose that your father died. Then, according to the principles mentioned above, you and your sibling, and your mother as a spouse of the inheritee will be at the 1st rank of the inheritors.

Then what about your children? Your children are also one of the lineal descendants of your father (they are your father’s grandchildren), but you and your sibling are closer than your children to your father. Therefore, even though your children being his lineal descendant, cannot inherit your father, not to mention your spouse who is not his lineal descendant.

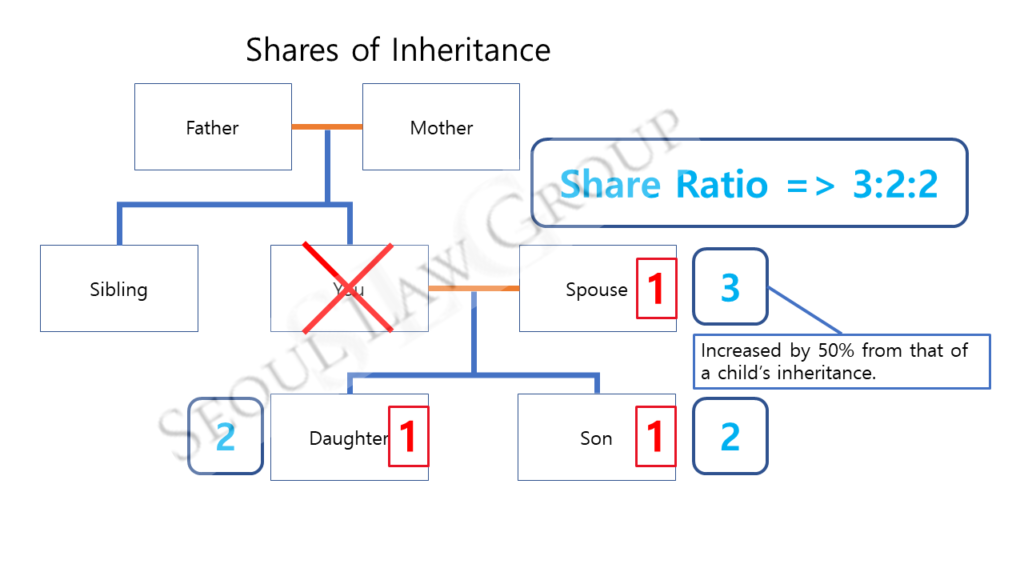

5. Case No.3 – Inheritance by Representation (Link from 4. Inheritance by Representation)

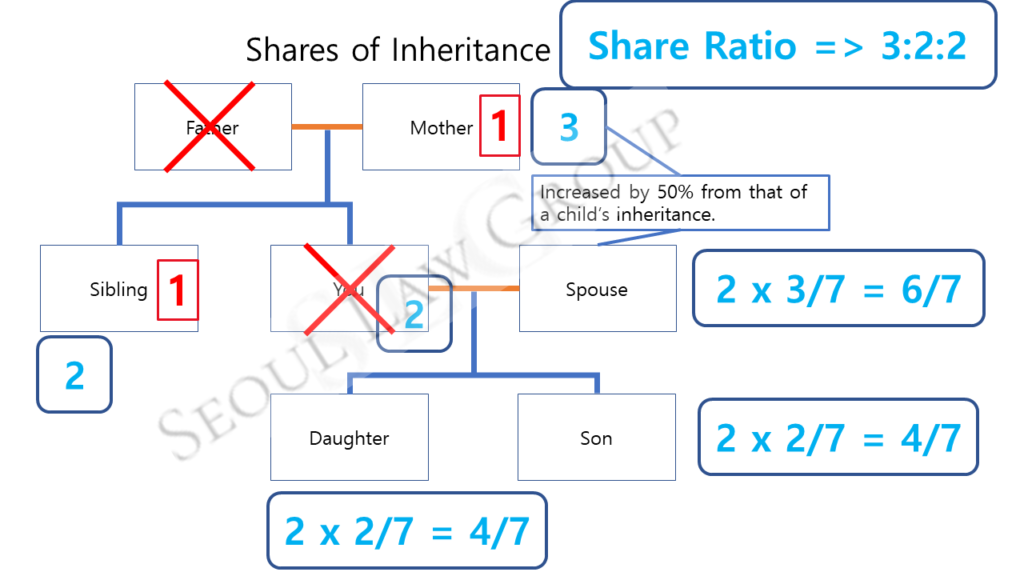

Suppose you have already passed away, and now your father died. Can your children and spouse be the inheritors (while your sibling and your mother are still alive)? This question can be generalized and modified as “what happens when the inheritor dies before the inheritee?” This case is the very typical form where the “inheritance by representation” principle works.

Let’s suppose there is no such thing as the principle of inheritance by representation. Then, for Case No.3, the inheritors would be your sibling and your mother. Your sibling, as the closest among the lineal descendants, will have the priority of inheritance (he or she outranks your children.) Your sibling and your mother will split the inheritance property. This leads to the conclusion that your children and your spouse will get nothing, not even a penny.

This hypothetical result is quite unacceptable when compared to the case of you still being alive. If you were still alive, then you, your sibling, and your mother will split the inheritance property, and later, your children and your spouse will split your property (including your inherited property from your father). The reason for the difference between the former and the latter is only the fact that you died before your father.

Fortunately, Korean Civil Law has the principle of “inheritance by representation.” According to the principle, although you have already passed away, your children and spouse will still have the right to inherit ‘your right to inherit your parents’. This family tree will help your understanding.

As shown in the family tree, the inheritance property of your father would be divided into 2:2:3, each to your sibling, you, and your mother. Then, your children and spouse, as they have the right to inherit your right to inherit, will split the property again by 2:2:3. Your children and spouse can also inherit your parents even if you are always gone. To put it another way, in the perspective of a grandchild, you still have a right to inherit your grandparents, even if your parents have already passed away while your aunts and uncles are alive.

Conclusion

In this article, we have discussed some specific cases of inheritance in Korean law. The key point is you still have the right to inherit your grandparents, even if your parents have already passed away. Law and principles of inheritance in Korea are quite complicated and confusing, therefore figuring out the inheritance property and inheritors is never an easy job, even for lawyers. Seoul Law Group has extensive experiences on inheritance in Korea, so better not hesitate to contact us.